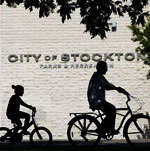

Stockton, California, filed for bankruptcy in July 2012  FRONT PAGE Site Search About us    Mayors explore guaranteed income targeted at low-income Americans US bankrupt cities Fiscal control boards in the US US subprime mortgage crisis US cities seek extra revenue Community Land Trusts LA in real estate crisis NYC prepares for future Local government finance - USA US cities finances Cell phone tax NC local government finance Municipal bonds Local government mergers US cities' legal powers US metro economies 2006 Poverty in US cities  Worldwide | Elections | North America | Latin America | Europe | Asia | Africa |                           |

The US communities most in danger of going bankrupt 5 December 2012: In October 2012, Moody’s, the US credit rating agency, published a report which rated the debt of 30 US cities, towns, villages, counties and school districts as ‘speculative grade’. A year ago only 25 communities were given speculative grades.

* According to Moody's, the purpose of its ratings is to "provide investors with a simple system of gradation by which future relative creditworthiness of securities may be gauged". Aaa to Baa3 are described as investment grade with low to moderate credit risk. Ba1 to C are described as speculative grade with significant credit risk or already being in default. Follow @City_Mayors |

|